Why Control Beats Income in Nigeria’s Economy (And How to Build It)

Introduction: The Nigerian Money Paradox In Nigeria today, it is entirely possible to earn more money and still feel poorer. Salaries rise, side hustles multiply, and yet anxiety increases. Bills arrive faster than income. Emergencies feel constant. Financial decisions are rushed, emotional, and reactive. This is the Nigerian money paradox: income is growing, but control is shrinking. Unfortunately, income does not create financial stability in… Read More

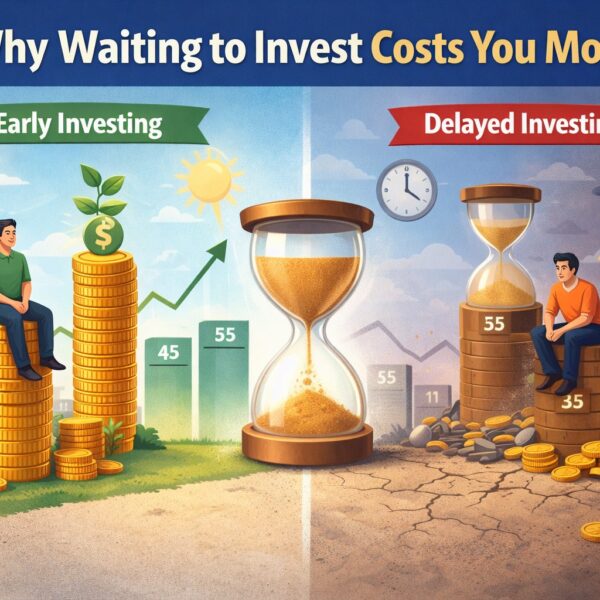

Why Waiting to Invest Costs You More

Many Nigerians believe they are being cautious by waiting to invest. “I’ll invest when I earn more.”“I’ll invest after I clear all my bills.”“I’ll invest when things stabilize.” It sounds…

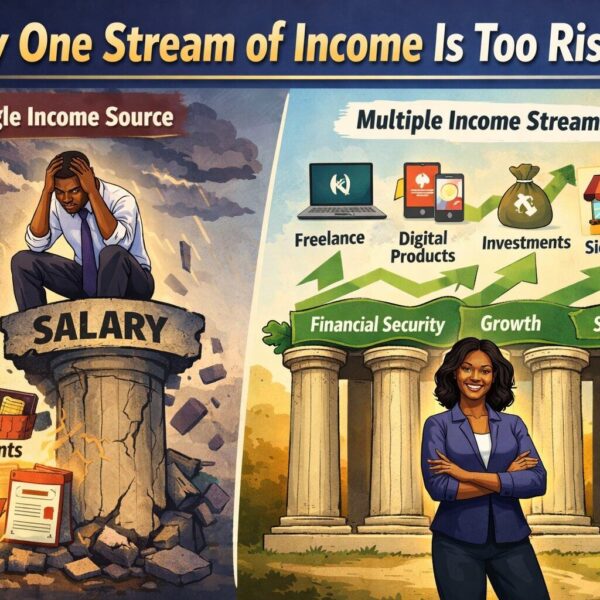

Why One Stream of Income Is Too Risky

Introduction: One Salary Is Not Security Anymore For decades, Nigerians were taught a simple formula for financial stability: Get a good education → Get a good job → Earn a…

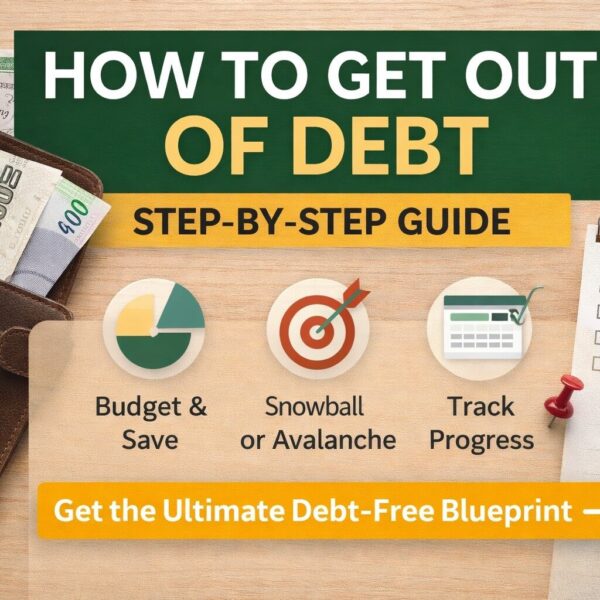

How to Get Out of Debt: A Practical Step-by-Step Guide

Debt is one of the fastest ways to feel stuck financially. You earn money, but it disappears.You try to save, but repayments swallow everything.You want to invest, but debt keeps…

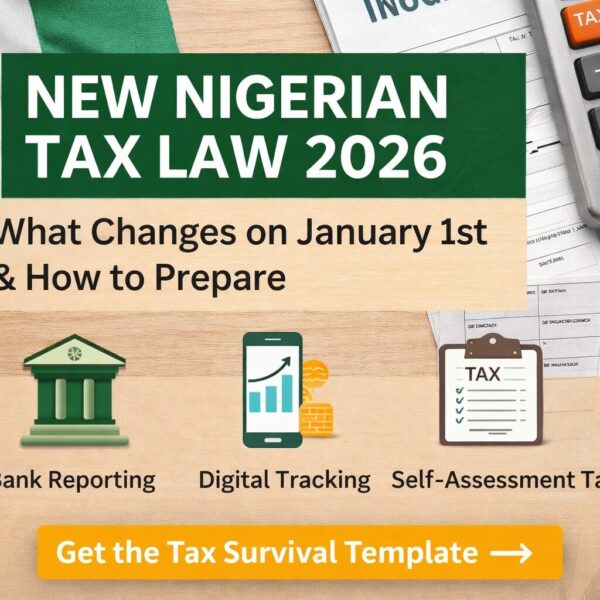

New Nigerian Tax Law 2026: What Changes on January 1st and How to Prepare Now

Introduction: 2026 Will Change How Nigerians Pay Tax From January 1st, 2026, Nigeria’s tax system will enter a new phase. The government is tightening compliance, expanding the tax net, and…