Introduction: One Salary Is Not Security Anymore

For decades, Nigerians were taught a simple formula for financial stability:

Get a good education → Get a good job → Earn a steady salary → You’re safe.

That formula no longer works.

In today’s economy, relying on a single stream of income is one of the riskiest financial positions you can be in. Layoffs, inflation, delayed salaries, business shutdowns, health emergencies, policy changes, and currency instability have made income fragility a real problem for millions of people.

This is not about panic.

It is about preparation.

In this article, you will learn:

- Why one income stream is financially dangerous

- The hidden risks most people ignore

- The types of additional income that actually work

- How to build multiple income streams without burning out

- How this fits into a long-term wealth strategy

No hype. No hustle culture. Just structure.

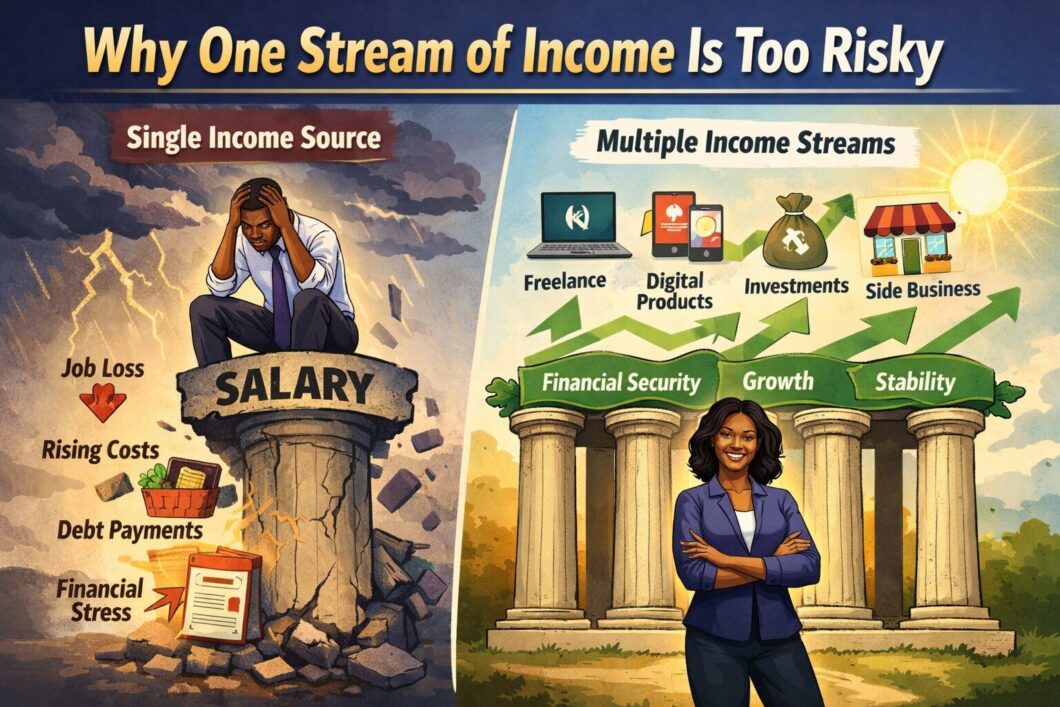

Why One Stream of Income Is a Financial Trap

1. You Have a Single Point of Failure

When all your income comes from one source, any disruption becomes catastrophic.

If your salary stops, your business slows down, or your client disappears:

- Rent is still due

- Bills still arrive

- Debt repayments continue

- Family responsibilities don’t pause

This is called income concentration risk and it is the same mistake investors are warned never to make with their portfolios.

Yet many people concentrate 100% of their livelihood on one paycheck.

2. Inflation Eats Fixed Income Quietly

A single income stream is usually fixed or slow-growing, especially salaries.

But expenses are not fixed.

- Food prices rise

- Transport costs increase

- Rent goes up

- Utility bills fluctuate

When your income grows slowly, but your expenses grow aggressively, you are effectively getting poorer every year, even if your salary remains “stable.”

This is why many people feel like they are working harder but saving less.

3. Job Security Is an Illusion

There is no such thing as permanent job security anymore.

Companies restructure.

Budgets get cut.

Roles become redundant.

Technology replaces tasks.

Even business owners are not immune:

- Clients leave

- Regulations change

- Cash flow dries up

Depending on one source of income means your entire financial life is tied to decisions you do not control.

The Psychological Cost of One Income Stream

Beyond money, there is an emotional cost.

When you rely on one income:

- You tolerate bad working conditions

- You fear speaking up

- You avoid calculated risks

- You postpone long term plans

Money stress limits decision making.

This is why financial flexibility is not just about wealth; it is about mental freedom.

This principle is central to Rich, Young & African: wealth is not just accumulation; it is control.

Multiple Income Streams ≠ Hustling Nonstop

One of the biggest misconceptions is that multiple income streams mean:

- Working 18 hours a day

- Running five businesses at once

- Burning out

That is not the goal.

The goal is income diversification, not exhaustion.

Think of income like a table:

- One leg = unstable

- Two legs = shaky

- Three or more legs = balanced

Each stream does not need to be massive.

They need to be reliable and intentional.

Types of Income Streams You Should Consider

1. Active Income (Your Primary Skill)

This includes:

- Salary

- Freelancing

- Consulting

- Professional services

This is usually your starting point.

The mistake is stopping here.

2. Skill-Based Side Income

These are incomes tied to skills you already have:

- Writing

- Design

- Data analysis

- Teaching

- Strategy

- Operations

- Coaching

You do not need capital to start these.

You need clarity.

This is exactly what No Capital? No Problem teaches: how to identify skills you already have and turn them into income without increasing financial pressure.

3. Scalable Digital Income

This includes:

- eBooks

- Courses

- Templates

- Paid communities

- Digital services

The advantage:

- Built once

- Sold repeatedly

- Not tied to hours worked

This is where income starts to decouple from time.

4. Investment Income (Later, Not First)

Investments are important, but they are not the first step.

If:

- Your cash flow is unstable

- You are in debt

- You struggle to save consistently

Then investing prematurely adds stress.

This is why your foundation must come first:

- Budgeting

- Debt control

- Income stability

Wealth is built in sequence, not in shortcuts.

Why Most People Fail at Building Extra Income

1. They Chase Trends Instead of Structure

People jump from:

- Crypto to forex

- Dropshipping to real estate

- One online trend to another

Without structure, nothing compounds.

2. They Ignore Time and Energy Limits

Not every income stream fits your lifestyle.

The best side income:

- Aligns with your skills

- Fits your schedule

- Does not sabotage your primary income

3. They Expect Immediate Results

Income diversification is a medium term strategy.

Consistency beats intensity.

This is why systems matter more than motivation.

How to Start Building a Second Income Stream (Practically)

Step 1: Stabilize Your Finances First

If you don’t control your money, extra income will disappear.

Start with:

- A working budget

- Clear expense tracking

- Debt reduction

Step 2: Identify Income Ready Skills

Ask:

- What do people already ask me for help with?

- What do I do easily that others struggle with?

- What skills have I used in past jobs or projects?

Skills are assets.

Step 3: Choose One Extra Stream (Not Five)

Focus creates momentum.

One additional stream, built properly, is better than five abandoned ideas.

Step 4: Reinvest, Don’t Inflate Lifestyle

Extra income should:

- Strengthen savings

- Clear debt faster

- Fund investments

- Build assets

Lifestyle upgrades come later.

How This Fits Into My Wealth Framework

My approach to wealth is simple:

- Control your money (budgeting)

- Eliminate financial pressure (debt)

- Increase income intentionally

- Build assets

- Protect and scale wealth

This is the structure taught across:

Wealth without structure collapses.

Income without strategy leaks.

Frequently Asked Questions (FAQs)

1. How many income streams should I have?

Start with two. Quality and stability matter more than quantity.

2. Can I build extra income while working full-time?

Yes, if the income fits your schedule and energy levels.

3. Should I invest before building extra income?

Only if your cash flow and debt are under control.

4. Is multiple income only for entrepreneurs?

No. Professionals benefit even more because their skills are valuable.

5. How long does it take to build a second income?

Typically, 3-6 months with consistency and structure.

Final Thoughts: Income Diversity Is Not Optional Anymore

Relying on one income stream is no longer conservative.

It is risky.

The goal is not to hustle endlessly.

The goal is to design resilience into your finances.

Your future will not be secured by hope.

It will be secured by structure.