Introduction: The Nigerian Money Paradox In Nigeria today, it is entirely possible to earn more money and still feel poorer. Salaries rise, side hustles multiply, and yet anxiety increases. Bills arrive faster than income. Emergencies…

Browsing Category General

Why Waiting to Invest Costs You More

Many Nigerians believe they are being cautious by waiting to invest. “I’ll invest when I earn more.”“I’ll invest after I clear all my bills.”“I’ll invest when things stabilize.” It sounds responsible.It feels safe. But in…

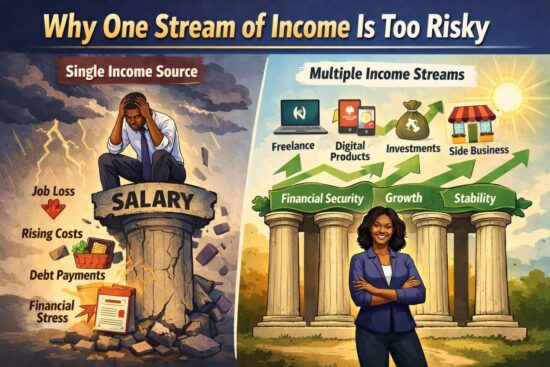

Why One Stream of Income Is Too Risky

Introduction: One Salary Is Not Security Anymore For decades, Nigerians were taught a simple formula for financial stability: Get a good education → Get a good job → Earn a steady salary → You’re safe….

How to Get Out of Debt: A Practical Step-by-Step Guide

Debt is one of the fastest ways to feel stuck financially. You earn money, but it disappears.You try to save, but repayments swallow everything.You want to invest, but debt keeps pulling you backwards. If this…

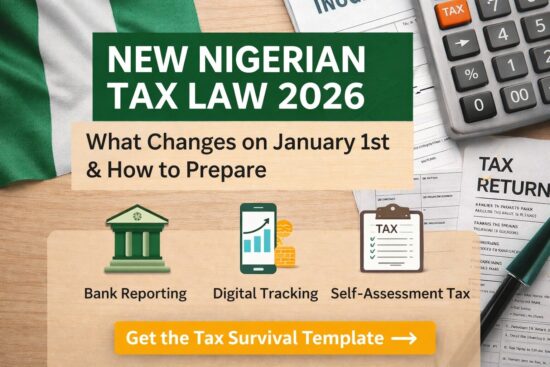

New Nigerian Tax Law 2026: What Changes on January 1st and How to Prepare Now

Introduction: 2026 Will Change How Nigerians Pay Tax From January 1st, 2026, Nigeria’s tax system will enter a new phase. The government is tightening compliance, expanding the tax net, and using digital tools to monitor…

Retirement Planning in Nigeria: What to Do in Your 20s and 30s

If you’re in your 20s or 30s, retirement probably feels like a distant planet; something meant for older people who drink Lipton tea every morning and talk about “the good old days.” Retirement is not…

Low-Capital Side Hustles in Nigeria (Practical Ideas You Can Start This Week)

If you live in Nigeria today, one income is no longer enough.Inflation is rising, salaries are not keeping up, and the cost of living hits harder every month. But here’s the truth:You don’t need ₦500k…

Tax Guide for Freelancers in Nigeria: What You Must Know (2026)

Freelancing in Nigeria has exploded; designers, writers, tech professionals, virtual assistants, influencers, coaches, consultants, and creators are making real money outside traditional employment. But there’s one part most freelancers still avoid: 👉 TAX. And with…

7 Ways Nigerians Can Protect Their Savings From Inflation (2025 Guide)

Inflation is one of the biggest threats to your financial progress in Nigeria today.Your savings are losing value every single month not because you’re careless, but because prices are rising faster than your money is…

Budgeting with Irregular Income in Nigeria: A Simple Guide for Freelancers & Gig Workers

If you’re earning via gigs, contracts, or freelancing in Nigeria, you know the challenge: one month you might earn ₦500,000; the next month it might be ₦80,000. Without a salary guarantee, budgeting can feel like…