Why Waiting to Invest Costs You More

Many Nigerians believe they are being cautious by waiting to invest. “I’ll invest when I earn more.”“I’ll invest after I clear all my bills.”“I’ll invest when things stabilize.” It sounds responsible.It feels safe. But in reality, waiting to invest is one of the most expensive financial decisions you can make because you lose time, and time is the most powerful asset in wealth building. This… Read More

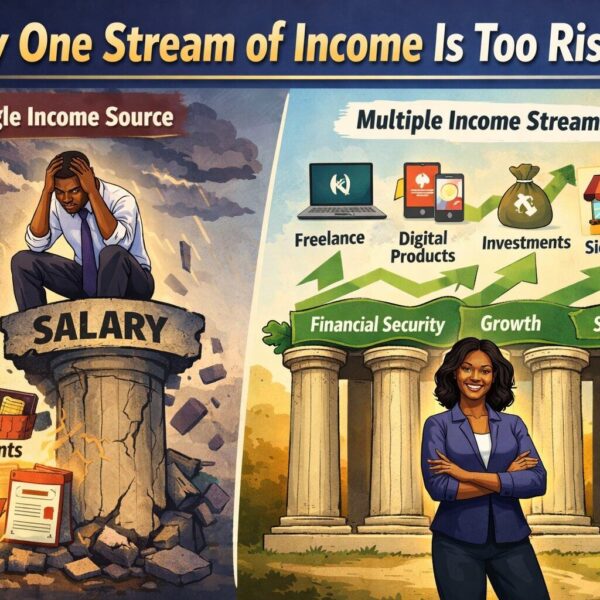

Why One Stream of Income Is Too Risky

Introduction: One Salary Is Not Security Anymore For decades, Nigerians were taught a simple formula for financial stability: Get a good education → Get a good job → Earn a steady salary → You’re safe. That formula no longer works.…

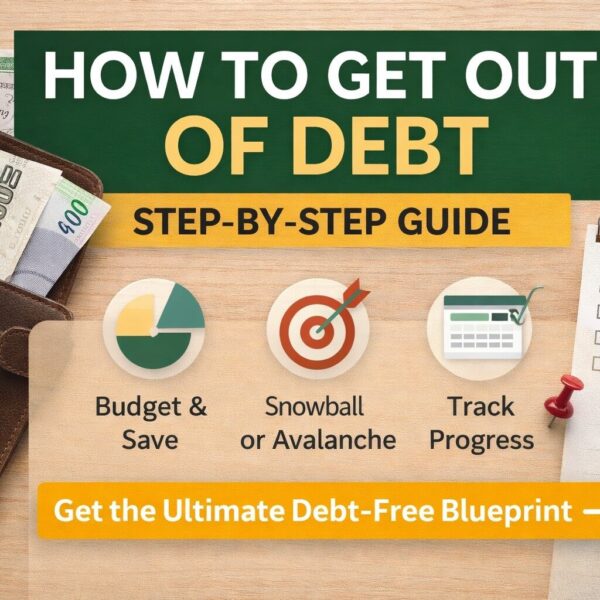

How to Get Out of Debt: A Practical Step-by-Step Guide

Debt is one of the fastest ways to feel stuck financially. You earn money, but it disappears.You try to save, but repayments swallow everything.You want to invest, but debt keeps pulling you backwards. If this sounds familiar, you are not…

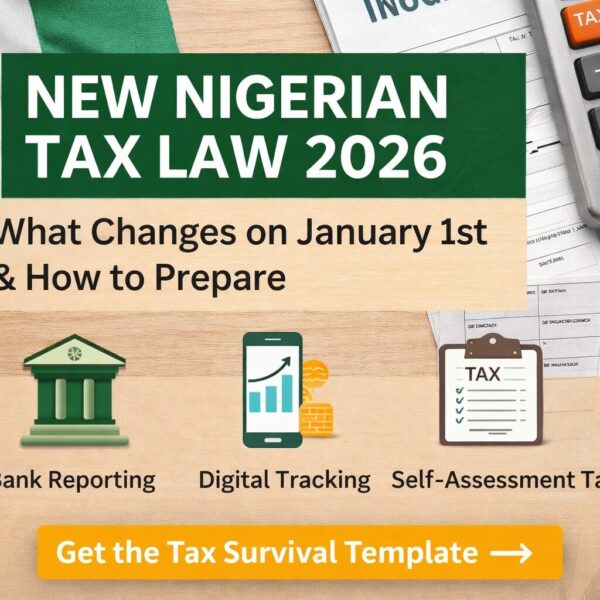

New Nigerian Tax Law 2026: What Changes on January 1st and How to Prepare Now

Introduction: 2026 Will Change How Nigerians Pay Tax From January 1st, 2026, Nigeria’s tax system will enter a new phase. The government is tightening compliance, expanding the tax net, and using digital tools to monitor income more closely than ever…

Retirement Planning in Nigeria: What to Do in Your 20s and 30s

If you’re in your 20s or 30s, retirement probably feels like a distant planet; something meant for older people who drink Lipton tea every morning and talk about “the good old days.” Retirement is not about age. It’s about preparation.…